It never ceases to amaze me how most people are fools with their money. A recent report confirms my suspicions that baby boomers are just as irresponsible with their money and act on their short-term interests. Very short, term interest. Just like most young people today, instant gratification takes too long.

Homeowners' behavior during the recent housing boom in the U.S. left American soon-to-be retirees in worse shape approaching retirement, because a house accounts for half of the property and financial wealth of the typical household approaching retirement age, according to the Center for Retirement Research at Boston College.

Alicia Munnell, the center's director, looked into how the housing bubble affected retirement security in a recent report with Mauricio Soto, a research economist at the center.

Here are some key findings of the report, released this month:

Alicia Munnell, the center's director, looked into how the housing bubble affected retirement security in a recent report with Mauricio Soto, a research economist at the center.

Here are some key findings of the report, released this month:

- • Many households reacted to the gain in housing prices by taking money out and increasing their debt. The center estimates that households extracted about $1.2 trillion of their home equity during the boom from 2001-06.

• Total debt rose to 120 percent of disposable personal income in 2007 from about 80 percent in the early 1990s, according to government data.

• With most of their family responsibilities out of the way, households headed by homeowners older than 50 were more likely to take out home equity. All told, homeowners 50 to 62 years old took out about $380 billion from their primary residences and posted expenses of $149 billion, based on government data from the Federal Reserve System and the Case-Shiller Home Price Index.

• Homeowners with children were more likely to tap into their home equity, possibly to pay education and other expenses.

• Homeowners said they spent 10.5 percent of what they took out from their primary homes on expenses, including personal spending and repayment of credit-card debt; 23.5 percent to pay off past debts; 32.2 percent for home improvement; and 33.8 percent for investment in the stock market, real estate or business.

• For a typical homeowner nearing retirement (ages 50 to 62 in 2004), the gains in housing equity were nearly offset by additional spending. Their household net worth fell by an estimated $6,900, or 14 percent.

The report found that people increased mortgage debt by $1.2 trillion during the housing boom and increased consumption by $410 billion.

As I have said before, so much for houses as investments for retirement. Again, houses are consumer products and not investments. If you are buying a house on the hope that it will go up, you are speculating. If you are speculating, you should be prepared for the price to go down instead of up. Don't blame anyone else when your house price goes down. You caused this situation to happen by believing what the shady real estate agents and mortgage lenders have told you.

If you want to be financially well-prepared for retirement, invest in yourself by spending as much money as you can on books, seminars, and motivational tapes on how to run your own business or how to make money on the Internet. Fact is, your most valuable asset is actually your ability to earn an income.

Your enhanced earning power that comes from your superior skills and knowledge should be part of overall retirement plan. Although the banks and other financial institutions don't count intangibles such as creativity, innovative character, risk-taking ability, and specialized knowledge in tallying your net worth, you should. These items are much more important to a retirement portfolio than a house.

As I have said before, so much for houses as investments for retirement. Again, houses are consumer products and not investments. If you are buying a house on the hope that it will go up, you are speculating. If you are speculating, you should be prepared for the price to go down instead of up. Don't blame anyone else when your house price goes down. You caused this situation to happen by believing what the shady real estate agents and mortgage lenders have told you.

If you want to be financially well-prepared for retirement, invest in yourself by spending as much money as you can on books, seminars, and motivational tapes on how to run your own business or how to make money on the Internet. Fact is, your most valuable asset is actually your ability to earn an income.

Your enhanced earning power that comes from your superior skills and knowledge should be part of overall retirement plan. Although the banks and other financial institutions don't count intangibles such as creativity, innovative character, risk-taking ability, and specialized knowledge in tallying your net worth, you should. These items are much more important to a retirement portfolio than a house.

WARNING! WARNING! WARNING!

Retirement is a double-edged sword. You either make it work for you - or it will cut your happiness in half. The more you know about the secrets to a successful retirement, the happier you will be once you retire.

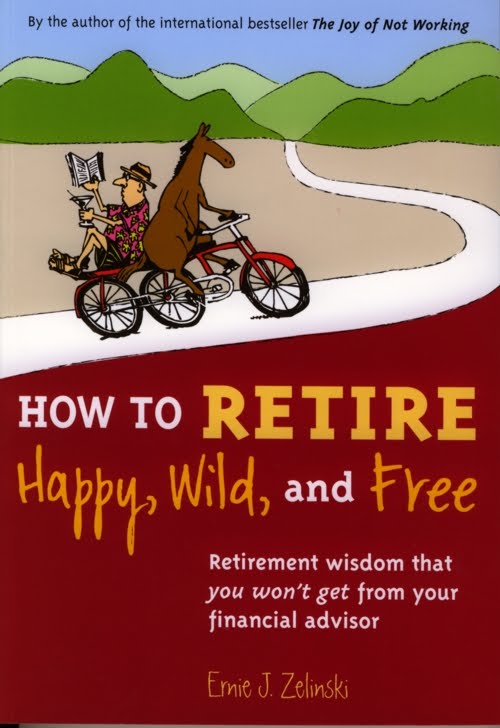

That's why you need The World's Best Retirement Book by Vipbooks Author Ernie J. Zelinski.

Over 100,000 Copies Sold

Published in 7 Foreign Languages

How to Retire Happy, Wild, and Free: Retirement Wisdom That You Won't Get from Your Financial Advisor is a provocative, entertaining, down-to-earth, and tremendously inspiring book that will help you get more joy and satisfaction out of all your retirement activities.

Although turned down by over 35 publishers, How to Retire Happy, Wild, and Free has already sold over 100,000 copies and has been published in 7 foreign languages since it was released by Ten Speed Press in Berkeley, California.

What's more, go to www.Amazon.com and type "retirement" into the search feature. You will see that How to Retire Happy, Wild, and Free appears in the number 1 position - out of over 175,000 listings for retirement books!

Purchase How to Retire Happy, Wild, and Free on Amazon.com with this direct link:

always enjoy your site...Iwould love to sell 100,000 copies of For Kids 59.99 & Over. Congrats to you..check mysite...www.carolstanley1.com..you never know where there are connections...

ReplyDelete